dupage county sales tax rate 2020

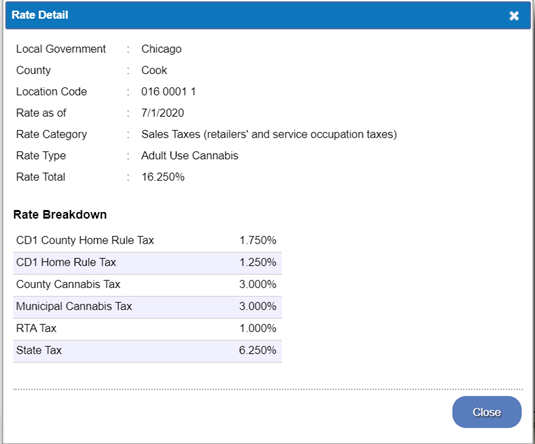

Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. If no registered tax buyer bids on a parcel DuPage County as Trustee for all DuPage County taxing bodies becomes the buyer at an interest rate of 18.

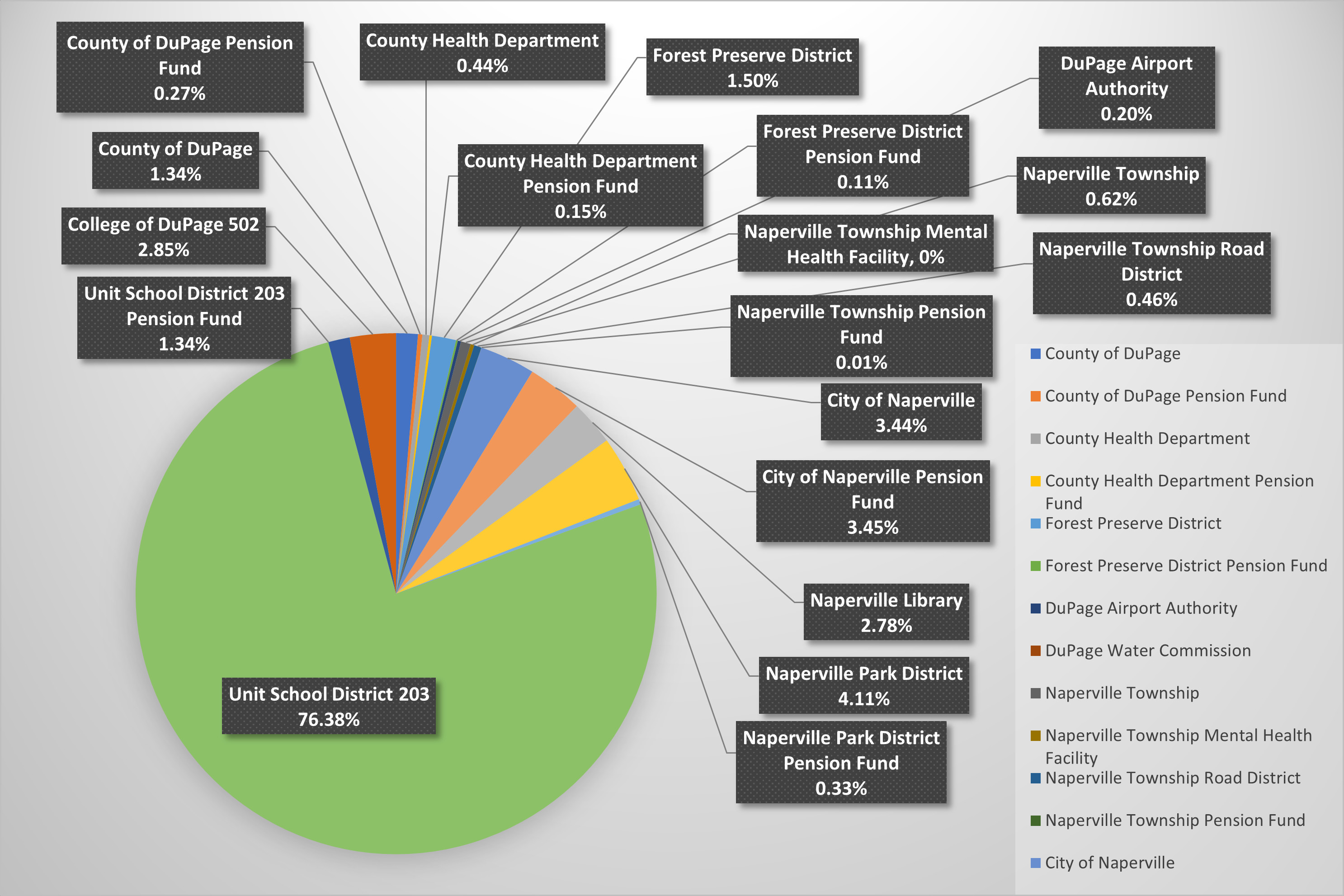

About Assessor Naperville Township

The average yearly property tax paid by DuPage County residents amounts to about 598 of their yearly income.

. DuPage County IL Sales Tax Rate. The current total local sales tax rate in DuPage County IL is 7000. The Illinois state sales tax rate is currently.

You may schedule to ePay your 2021 real estate tax bill on our website using your Visa MasterCard or Discover credit card for the transaction. The tax levies are adopted by each taxing districts board and. The current total local sales tax rate in DuPage County IL is 7000.

There are no forfeitures unsold. This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes. DuPage County is ranked 38th of the 3143 counties for property taxes as a.

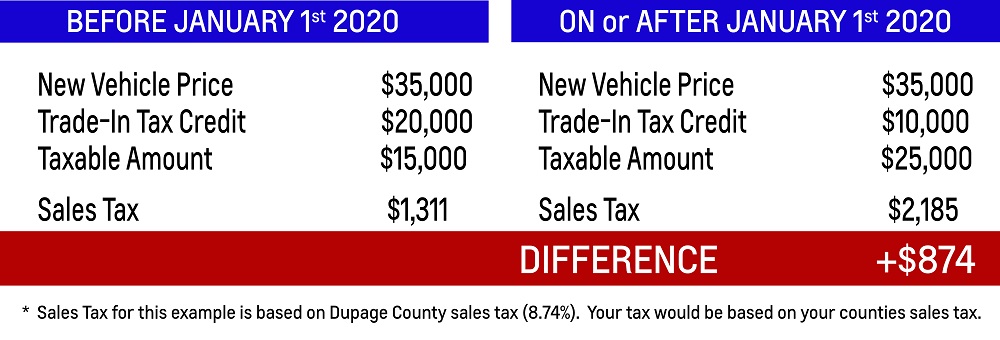

Its expected to raise over 16 million more a year. Average Sales Tax With Local. Thanks to the dupage county sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7.

Some cities and local governments in Dupage County collect. The 2018 United States Supreme Court decision in South Dakota v. 05 lower than the maximum sales tax in IL.

1000 for Costs 400 for Sales Certificate 2000 for Tax Sale Indemnity Fund 1000 for. Illinois has state sales tax of 625 and allows local. If you need access to a database of all Illinois local sales tax rates visit the sales tax data page.

1337 rows Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. All numbers are rounded in the normal fashion. As a note the average successful interest rate bid at the Tax Sale held in.

The base sales tax rate in dupage county is 7 7 cents per 100. The December 2020 total local sales tax rate was also 7000. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 79 in DuPage County Illinois.

The Du Page County Illinois sales tax is 700 consisting of 625 Illinois state sales tax and 075 Du Page County local sales taxesThe local sales tax consists of a 075 special district. While many counties do levy a countywide sales tax Dupage County does not. Please be aware that the credit card.

The statutory fees cover. The base sales tax rate in dupage county is 7 7 cents per 100. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due.

Tax buyers pay the tax amount due interest and a per parcel fee of 10400. The Illinois sales tax of 625 applies countywide. The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County.

The Dupage County sales tax rate is.

Dupage County Approves 5 Million Reduction In Property Tax Levy Shaw Local

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Funding Local Pensions With Real Estate Taxes Rub Brillhart Llc

North Central Illinois Economic Development Corporation Property Taxes

Business Climate Choose Dupage

Dupage County Taxes Tax Rate Information Dupageblog Com

Dupage County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Business Climate Choose Dupage

Referendum Tax Information Fenton Community High School

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

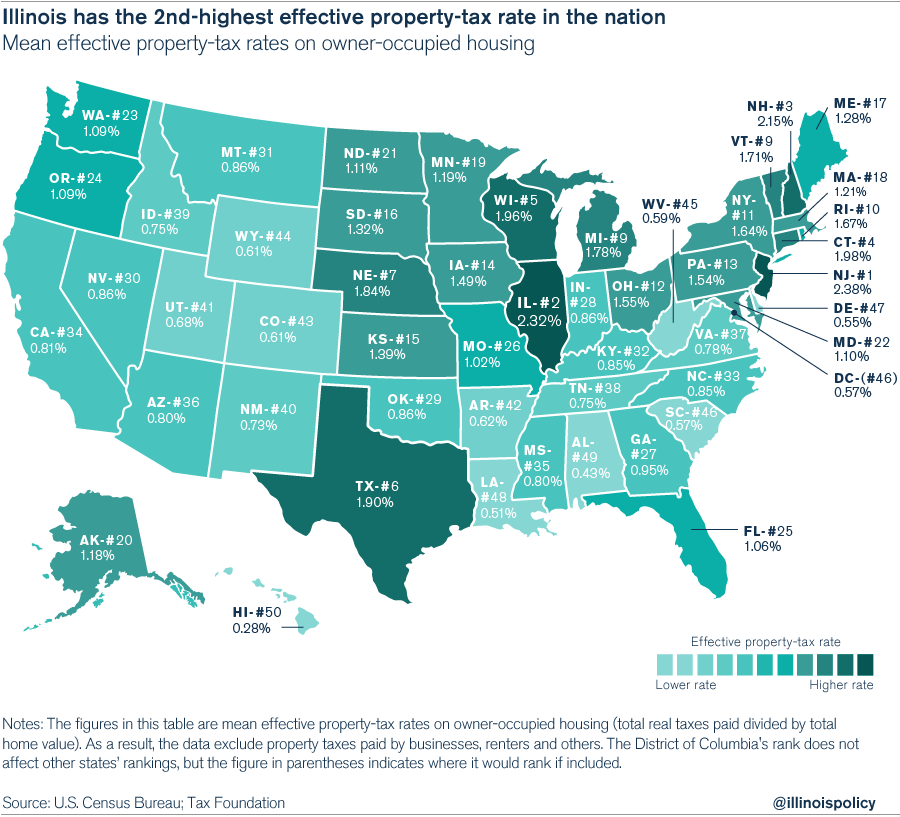

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

County And Municipal Cannabis Sales Taxes Go Into Effect July 1 The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Aurora Kane County Illinois Sales Tax Rate

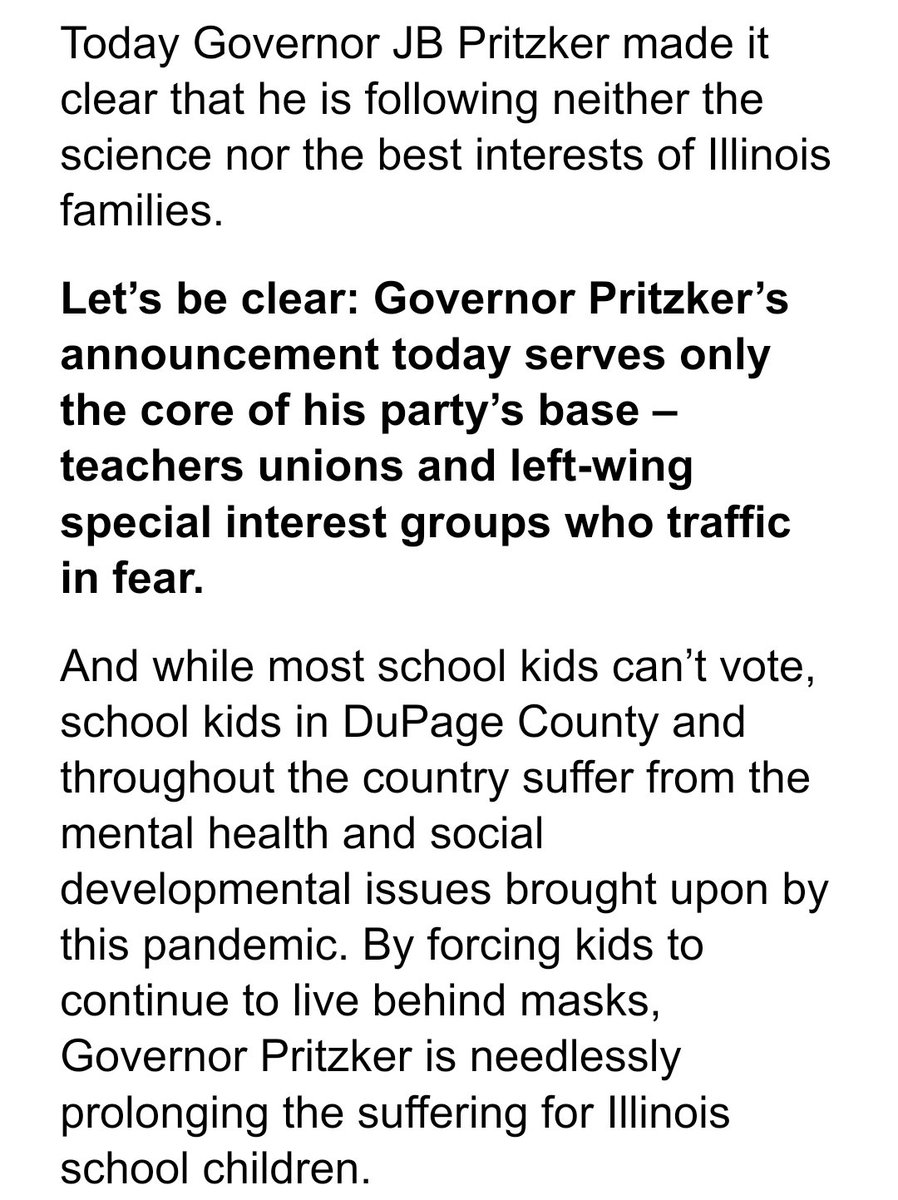

Dupage Gop Dupagecountygop Twitter

News Updates Dupage County Chairman Dan Cronin